operating cash flow ratio industry average

This corresponds to a value of 1 or little higher than 1. For further details see the case study.

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

The cash flow-to-debt ratio is a comparison of a firms operating cash flow to its total debt.

. A higher than industry average current ratio indicates that the company has a considerable size of short-term assets value in comparison to their short-term liabilities. Due to repayements of liabilities of 246 Industry improved Liabilities to Equity ratio in 1 Q 2022 to 143 above Oil And Gas Production Industry average. Value Investment Funds Two 12 Year Running Average Annual Return After Quarterly.

The formula for calculating the operating cash flow ratio is as follows. WRDS Industry Financial Ratio WIFR hereafter is a collection of most commonly used financial. Cash flow coverage ratio 80000000 38000000 2105.

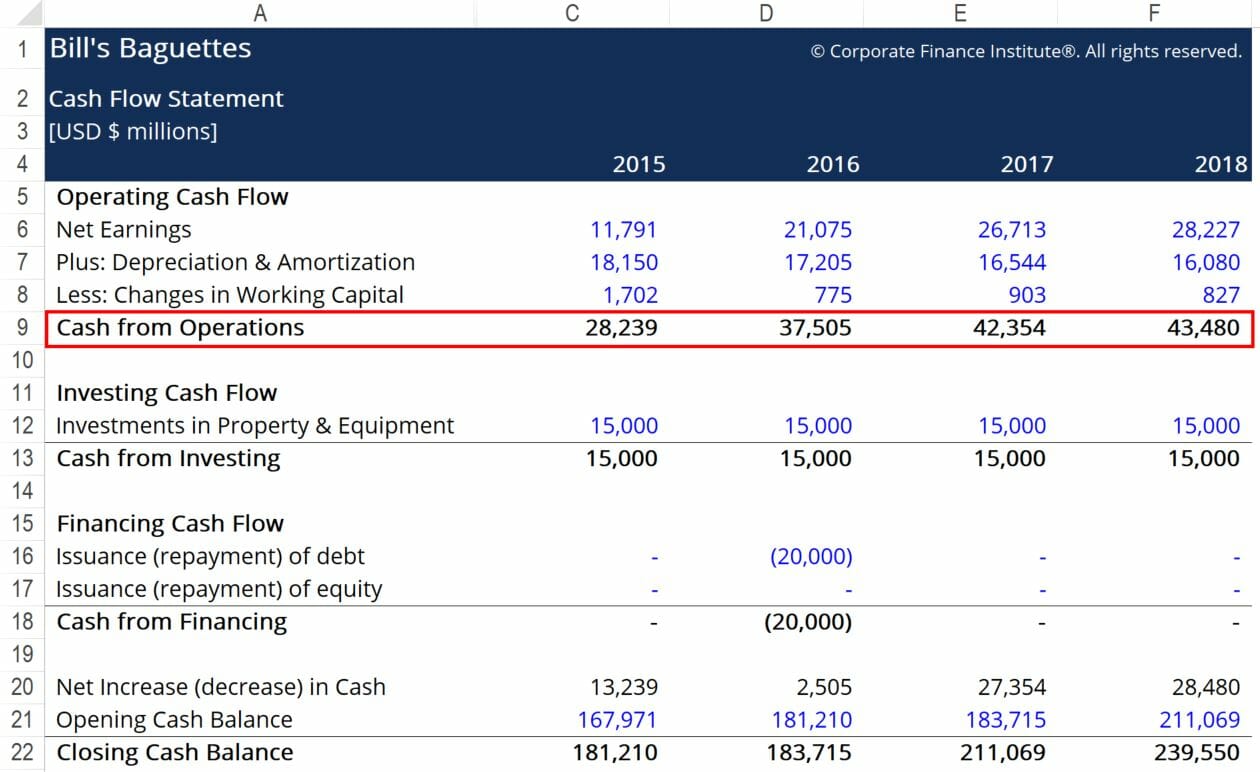

Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. A ratio shows how many times the first number contains the second number. Pretret_noa Profitability Operating Income After Depreciation as a fraction of average Net Operating Assets NOA based on most.

Price-to-Operating-Cash-Flow explanation calculation historical data and more. Leverage Ratio overall ranking has fallen relative to the prior quarter from to 28. WRDS Research Team.

In depth view into. Example of Cash Returns on Asset Ratio. This can be used as an indicator of how well a business can sustain its current cash management strategy in the long term.

10 or 110 10 or 10. Free Cash FlowOperating Cash Flow. An auditor should look at comparable ratios for the companys industry peers.

This ratio calculates whether a company can pay its obligations on its total debt including the debt with a maturity of more than one year. The CF or cash flow found in the denominator of the ratio is obtained through a calculation of the trailing 12-month cash flows generated by. Whereas the opposite.

You can calculate it by dividing the annual operating cash flow on the firms cash flow statement by current and long-term debt on the balance sheet. In other words Financial Ratios compare relationships. Lets consider the example of an automaker with the following financials.

500000 100000. Average industry financial ratios for Real Estate industry sector. 65 - Real Estate Measure of center.

Operating Cash Flow Ratio. Price-to-Operating-Cash-Flow as of today June 04 2022 is. Operating cash flow OCF ratio.

If the answer to the ratio is greater than 10 then the company is not in danger of default. The denominator is the average of the annual debt maturities scheduled over the next five years. Cash returns on assets cash flow from operations Total assets.

Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet. The Operating Cash to Total Cash Ratio measures how much of a business generated cash flow comes from its core operations. The user must understand how cash flow from operations is calculated.

Cash Returns on Asset Ratio 5. The ratio reflects a companys ability to repay its debts and within what time frame. Depreciation of 4000000 and amortization of 8000000.

For example an Assets to Sales Ratio Total Assets Net Sales. Alternatively the formula for cash flow from operations is equal to net income non-cash expenses changes in working capital. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

The cash flow coverage ratio is considered a solvency ratio so it is a long-term ratio. 75 rows Cash Ratio - breakdown by industry. 220 rows Operating cash flow ratio Operating cash flow Current liabilities.

Say you have 100000 in Total Assets and 1000000 in Net Sales your Assets to Sales would be 100000 1000000 or 1. Additionally a more conservative approach is used to verify so the credit analysts calculate again using EBIT along with depreciation and amortization. It means that the automaker generates a cash flow of 5 on every 1 of its assets.

WRDS Industry Financial Ratio. Cash ratio is a refinement of quick ratio and. Operating margin Return on sales 15.

A business that earns the bulk of its cash from its core operations will likely be able to. The operating cash flow. The statement of cash flows showed EBIT of 64000000.

Among other Industries in the Energy sector 3 other industries have achieved lower Leverage Ratio. Average industry financial ratios for US. Cash flow adequacy helps smooth out some of the cyclical factors that pose problems.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

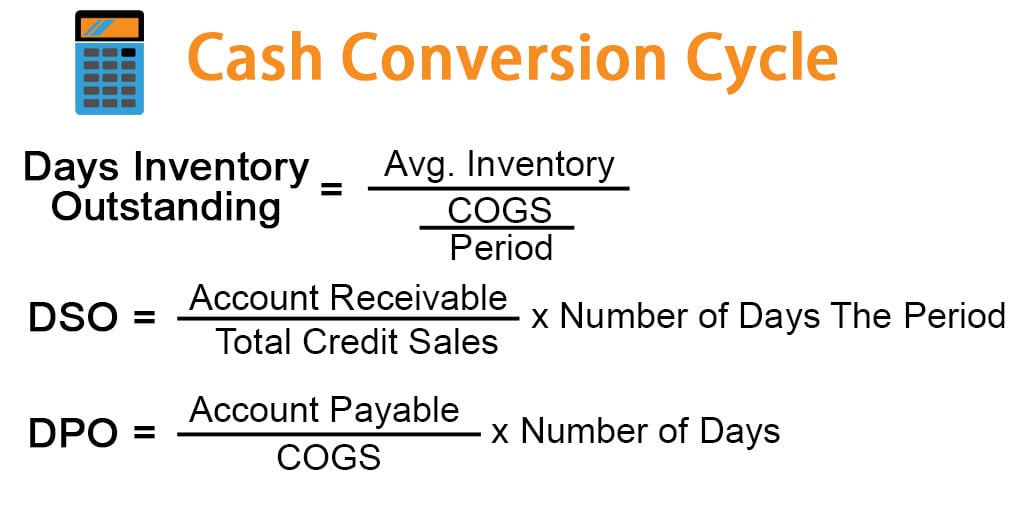

Cash Conversion Cycle Examples Advantages And Disadvantages

Operating Cash Flow Ratio Calculator

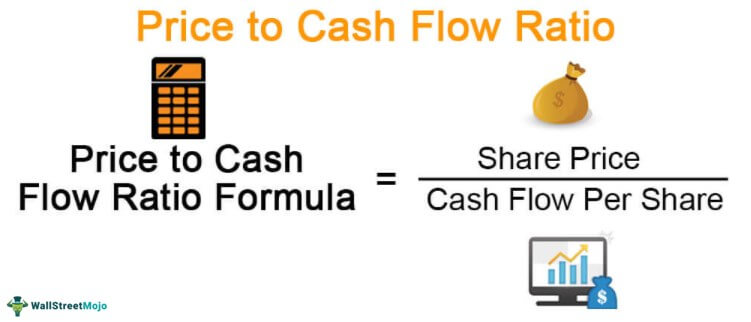

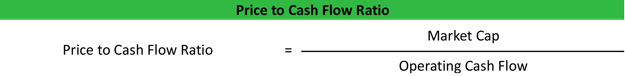

Price To Cash Flow Formula Example Calculate P Cf Ratio

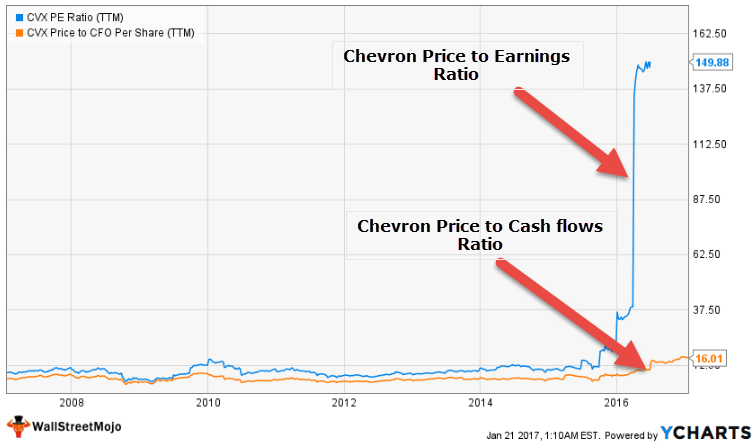

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow To Debt Ratio Meaning Importance Calculation

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow Per Share Formula Example How To Calculate

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Price To Cash Flow Formula Example Calculate P Cf Ratio

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Ratio Formula Guide For Financial Analysts